SARB considering move to lower inflation rate target

The Money Show talks to ETM Analytics' George Glynos about the implications of such a move.

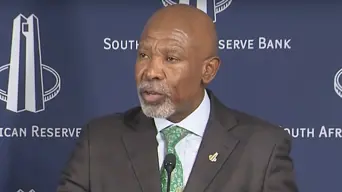

A YouTube screengrab of SA Reserve Bank Governor Lesetja Kganyago delivering the Monetary Policy Committee’s January statement on 25 January 2024.

Discussions are reportedly under way to lower South Africa's inflation rate target.

In a Reuters interview, SA Reserve Bank Governor Lesetja Kganyago said he would prefer a decision that would lower the target rate before 2025.

Kganyago reported that teams from the SARB and National Treasury were still identifying the appropriate range, and risks associated with it.

The current target band is 3-6%.

The Governor, whose term has been extended for five years, has long expressed the view that this is too wide and serves to anchor inflation expectations higher than the Bank would like.

RELATED: Kganyago's reappointment will keep SA's financial system stable - Banking Association of SA

What the Reserve Bank is trying to do here is to bring us more in line with global norms, says George Glynos, Head of Research at ETM Analytics.

"With many of South Africa's trading partners you'll see their inflation targets are not only lower than ours, but over time you find policies that target that lower inflation tend to improve price stability of those countries."

"One of the consequences is to help enhance the stability of the currency, which is something we could do with in this country as well."

George Glynos, Head of Research - ETM Analytics

In the past there was a tendency for tolerance of inflation towards the upper end of the target band Glynos says.

That, in turn, has inflation expectations also hugging the upper band of the 3-6% target limit.

"When Governor Kganyago came in, he progressively shifted the narrative towards targeting the midpoint of the 3-6% target range, which obviously sits at around 4.5%."

"I think he would like to see that lower still... from what I've understood, closer to a 3% target range which would be more consistent with what we've seen in other countries."

George Glynos, Head of Research - ETM Analytics

What would lowering the inflation target mean for interest rates?

Glynos notes that interest rates aren't just a function of monetary policy, but also of how a government runs itself.

RELATED: Inflation climbs to four-month high as interest rate decision looms

He advocates for a two-pronged approach involving the central bank and government.

"You want your central bank to be targeting lower inflation, and that would allow them to reduce interest rates...

"...but you'd also want that government to do its part to run itself efficiently, to rid itself of corruption... and the combination of those would certainly lead to lower inflation rates in time."

George Glynos, Head of Research - ETM Analytics

Scroll to the top of the article to listen to Glynos' analysis