Tariff Trouble: We interview SARB Governor Lesetja Kganyago on how South Africa plans to handle collapsing US exports

Sara-Jayne Makwala King

16 July 2025 | 10:56With 30% US tariffs on South African imports set to kick in on 1 August, Reserve Bank Governor Lesetja Kganyago says the country is bracing for impact thanks to early forward planning.

- South African Reserve Bank Governor Lesetja Kganyago

- South African Reserve Bank (SARB)

- Inflation

- 702 Breakfast with Bongani Bingwa

- Bongani Bingwa

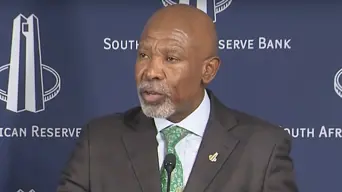

A YouTube screengrab of SA Reserve Bank Governor Lesetja Kganyago delivering the Monetary Policy Committee’s January statement on 25 January 2024.

702's Bongani Bingwa is joined by Lesetja Kganyago, Governor of the South African Reserve Bank (SARB).

Listen below:

The global economy is navigating turbulent times, and South Africa faces fresh pressure as the US imposes new tariffs on its exports.

The 30% US tariffs on South African imports are scheduled to take effect on 1 August.

Kganyago acknowledges that these are highly uncertain times, but says the SARB engaged in forward planning at the start of the year.

ALSO READ: We interview Minister Steenhuisen, who raises alarm over 30% US tariff hike and AGOA

"In our January meeting, we started assessing the impact on South Africa should AGOA not be renewed... and we also made an assumption; what if the US imposes a 25% tariff on South Africa?"

- Lesetja Kganyago, Governor - South African Reserve Bank

Kganyago says the two industries most affected by the tariffs are the automotive and the agriculture sectors.

"South Africa's export of vehicles to the US is down close to 82% six months to date compared to last year... that is very concerning."

- Lesetja Kganyago, Governor - South African Reserve Bank

"The impact on the agriculture sector could actually be quite devastating because it employs quite a lot of low-skilled workers."

- Lesetja Kganyago, Governor - South African Reserve Bank

Kganyago warns that in that sector, without alternative measures, up to 100,000 jobs could be at risk.

ALSO READ: South Africa turns to Middle East and Asia to fill trade gap left by US tariffs

In light of the new tariffs, South Africans are left wondering what action, if any, SARB will take to minimise the hit.

There’s growing talk of lowering the inflation target.

Some say this would boost investor confidence and discipline expectations, while others warn it could stifle an already fragile economy.

"The evidence that we are seeing is that there would be benefits from the lowering of the target."

- Lesetja Kganyago, Governor - South African Reserve Bank

"At an inflation rate of 6% we will have prices double every 12 years... would you like poor people to face prices that are doubling every 12 years...?"

- Lesetja Kganyago, Governor - South African Reserve Bank

Tariffs, inflation and the economy... to hear the full conversation with Kganyago, scroll up to the audio player.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.