Budget 3.0: Fuel levy will increase again in June, reveals Godongwana

Lindsay Dentlinger and Thabiso Goba

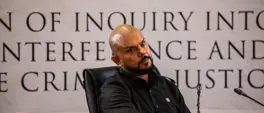

21 May 2025 | 12:49It’s one of the ways Finance Minister Enoch Godongwana is planning to fund the budget shortfall in this financial year.

CAPE TOWN - While an increase in value-added tax (VAT) is definitely off the table, you will be paying more for fuel.

After a three-year freeze, the fuel levy will increase again on 4 June 2025.

It’s one of the ways Finance Minister Enoch Godongwana is planning to fund the budget shortfall in this financial year.

He’s also warning that further tax proposals are in the pipeline for 2026.

ALSO READ: On average, fuel prices decreased by 3.2% between March and April - Stats SA

Following political backlash and legal contestation, there will be no VAT increase in this third iteration of the 2025 budget.

However, one of the trade-offs is once again activating increases in the fuel levy.

Godongwana had put a hold on the increase in 2022 to cushion the blow of global oil prices, pending a review of the fuel payment structure.

As from next month, the general fuel levy on petrol will increase by 16 cents to R4.01 per litre.

The levy on diesel will go up by 15 cents to R3.85 per litre.

“For the 2025/26 fiscal year, this is the only new tax proposal that I’m announcing. This is the first fuel levy increase in three years. Cut and join with the next line. Unfortunately, this tax measure alone will not close the fiscal gap over the medium term.”

With Godongwana deciding not to increase any other taxes, the pressure is now on the taxman to increase collections by at least R20 billion a year, to ward off proposed changes in other taxes in next year’s budget.

The proverbial sin taxes for alcohol and tobacco products remain unchanged from the increases which came into effect in March.

MK PARTY CRITICISES FREEZE LIFT ON FUEL LEVY INCREASE

The uMkhonto weSizwe (MK) Party has criticised raising the fuel levy, saying it’s as destructive as raising VAT.

The official opposition party says this reverses the positive step of scrapping the proposed hike on VAT.

MK Party parliamentary leader John Hlophe says the fuel levy will ultimately affect poor and working-class people the most.

“That is going to hit hard, the very poor people to begin with. It’s going to increase the cost of living, increase the cost of production. Food is going to go up because of the fuel levy, and transport is going to affect so many of our people. It’s not a pro-poor budget, it really supports the status quo; those who are rich are going to get richer.”

Get the whole picture 💡

Take a look at the topic timeline for all related articles.