Kganyago announces first rate cut since September, as SA embraces lowered inflation target

Paula Luckhoff

20 November 2025 | 20:13Reserve Bank Governor Lesetja Kganyago announced the Monetary Policy Committee's latest repo rate decision on Thursday.

- The Money Show

- Stephen Grootes

- South African Reserve Bank (SARB)

- Interest rates

- South African Reserve Bank Governor Lesetja Kganyago

- Interest rate

- Inflation

Reserve Bank Governor Lesetja Kganyago delivers the MPC statement on 20 November 2025. Facebook/SA Reserve Bank

The South African Reserve Bank (SARB) has opted for a rate cut, soon after the Finance Minister revised the inflation target downwards.

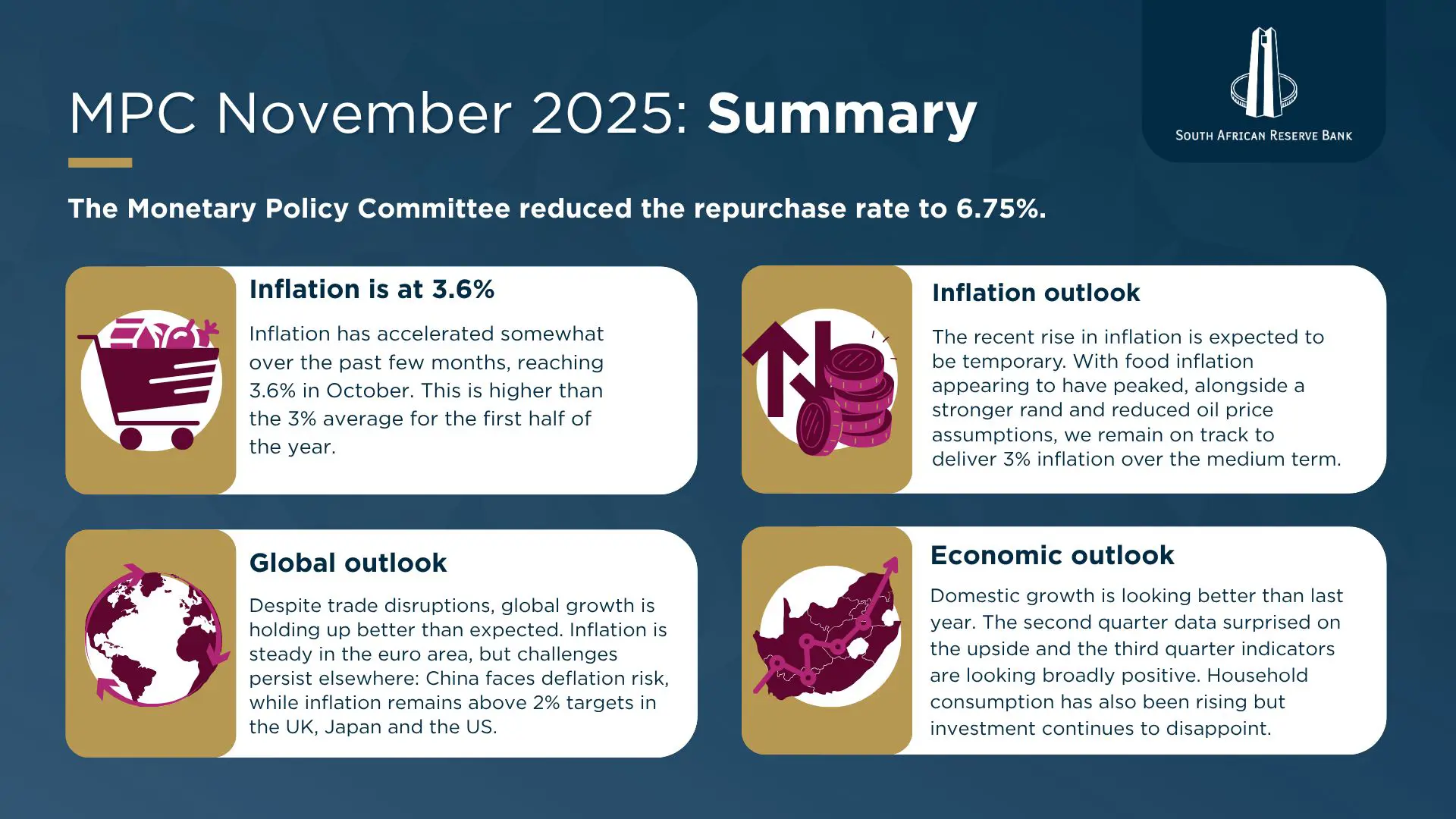

Delivering the Monetary Policy Committee (MPC) statement, Governor Lesetja Kganyago said the benchmark repo rate would drop to 6.75%, a cut of 25 basis points.

This means the prime lending rate now sits at 10.25%.

The central bank has cut interest rates by 150 basis points over the past year.

Kganyago said the decision by the Committee was unanimous, in contrast to the decision to hold ratesin September when two of the six members voted for a cut.

Thursday's announcement comes off the latest inflation figure of 3.7% in October, which reflected an increase in consumer inflation but core inflation remaining steady at 3.1%.

MPC members agreed there was scope to make the policy stance less restrictive, in the context of an improved inflation outlook.

The SARB pointed out that the revision of the inflation target from a 3‒6% range to a new point target of 3% with a 1 percentage point tolerance band, means prices will rise at a slower rate.

'Market rates and surveys of analysts both show further progress towards the 3% objective' Kganyago said, and the Reserve Bank assesses the risks to the inflation outlook as 'alanced'.

Summary of November 2025 MPC statement. Facebook/ SA Reserve Bank

Stephen Grootes gets comment from Isaah Mhlanga, chief economist at Rand Merchant Bank, who says RMB agrees with the statement that inflation is contained.

"This was conditional on the National Treasury adopting a 3% inflation target, which is exactly what happened last week... and then the currency strengthened, oil prices are lower than what the Reserve Bank forecast at the previous MPC meeting; and looking in terms of rate premiums, these have also declined as is visible in bond markets."

All of those factors combined, were reason enough for the MPC to say it's appropriate to cut rates by 25 basis points, Mhlanga says.

Scroll up to the audio player to hear Mhlanga's full analysis

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

15 January 2026 20:16

Parents play crucial role in preventing childhood internet addiction, new study confirms

15 January 2026 19:20

Health Funders Association open to negotiation on NHI, as Godongwana eyes truce amid court challenges

15 January 2026 18:40

Your rights when you dispute an adverse listing on your credit record