SA's Sappi eyes joint venture with European giant to combine graphic paper businesses

Paula Luckhoff

4 December 2025 | 17:06The proposed tie-up with Finland-based UPM-Kymmene Corporation in Europe would deliver at least €100-million in yearly synergies, says Sappi CEO Steve Binnie.

Sappi paper manufacturing plant. Wikimedia Commons/ Kleon3

South-Africa created Sappi has announced a proposed tie-in with Finland-based UPM-Kymmene Corporation to create a joint venture company.

The two companies have signed a non-binding letter of intent to form a non-listed, independent 50/50 venture for graphic paper.

The joint venture will bring together Sappi’s European Graphic Paper business with UPM’s Communication Papers business in Europe, the UK and the US.

The transaction will be subject to the fulfilment of a number of regulatory and other conditions, including shareholder approval.

Shareholders seem to be in favour of the move, with Sappi shares rising 8% on the news on Thursday.

With all conditions met, the parties intend signing definitive agreements during the first half of the 2026 calendar year and expect to close the proposed transaction by the end of that year.

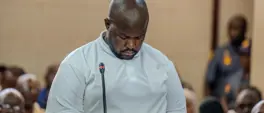

Sappi CEO Steve Binnie says that, as the largest players for graphic paper in Europe,they have a strong case for obtaining the approval which is key from the European Commission.

"We have approximately 55% market share in Europe between the two companies. We're confident of being able to get that approval, thinking of the decline we've seen over the years in demand for graphic paper, significant excess capacity, and also the increasing competition from imports out of Asia."

The proposed transaction will be structured to enable the parties to respectively contribute assets to the newly formed Joint Venture, with Sappi and UPM as founding shareholders and each holding 50% of the issued shares.

Binnie says that, ultimately, the transaction will enable Sappi to reduce debt in the medium term, and in the future the cash dividends from the joint venture will further lower debt.

To hear more detail from the Sappi CEO, listen to the interview audio at the top of the article

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

21 January 2026 20:49

Mr Price facing shareholder pressure over European expansion through NKD acquisition

21 January 2026 20:08

Team SA at Davos with sense of optimism that's been well received - Investec CEO

21 January 2026 19:22

How much more can retailers push prices with discounts before hitting a wall?