Godongwana announces lowered inflation target: 'It will benefit all South Africans, especially poorer households'

Paula Luckhoff

12 November 2025 | 17:24National Treasury's Duncan Pieterse explains the thinking behind the Finance Minister's announcement during his mini budget speech.

- The Money Show

- Stephen Grootes

- Enoch Godongwana

- Medium-term budget policy statement (MTBPS)

- Inflation

- South African Reserve Bank (SARB)

- National Treasury

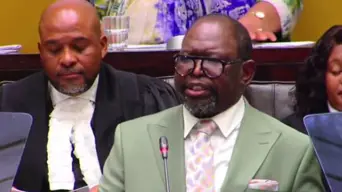

Finance Minister Enoch Godongwana tables the 2025 MTBPS. Screengrab from Government ZA video on YouTube.

Finance Minister Enoch Godongwana has lowered South Africa's inflation target to 3%, the lower end of what was the South African Reserve Bank's (SARB) 3-6% target band.

SARB governor Lesetja Kganyago sparked huge debate when he made an apparently unilateral statement during the July MPC statement about the Reserve Bank's preference to aim for 3%.

RELATED: ANC NEC pushes back against mooted lower inflation target - did Kganyago go too far?

The now official new inflation target of 3% comes with a 1 percentage point tolerance band and will be implemented over the next two years.

The 1 percentage point band provides flexibility to accommodate any unexpected inflationary shocks, Godongwana explained.

"Over time, the lower target will decrease inflation expectations and inflation, creating room for lower interest rates."

The Minister said his decision followed agreement with Governor Kganyago and consultations with the President and Cabinet.

In conversation with Stephen Grootes, National Treasury DG Duncan Pieterse says Wednesday's announcement is the culmination of more than a year's worth of work between Treasury and the Reserve Bank, preceded by a few years of research and various reviews.

Pieterse sketches how the lower inflation target will benefit the economy, and South African households.

He points to the recent drop in bond yields, explaining how that is the interest rate that government pays on X-bonds it issues to finance the budget deficit.

"Bond yields have come down by almost two percentage points over the last few months - 200 basis points, and the reason is in part because of the lower inflation environment."

This means interest rates have already started coming down, as bond yields set a lot of the other interest rates in our economy, Pieterse continues.

"So some of the benefits we have already seen... and certainly, if we're able to anchor inflation at 3% which is where it already is currently, and maintain that over the longer term, AS WELL as continue to build fiscal credibility as we've been able to over the last few months... interest rates should come down."

He lists some of the reasons a rate drop is important, including the cost of credit coming down for households.

"If interest rates are lower - and remember that over 60% of our GDP is linked to household consumption - then, secondly, the cost of capital comes down so we can invest more and deliver higher growth outcomes."

Scroll up to the audio player to listen to the full conversation

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

11 February 2026 20:30

Why companies are rethinking bonuses and benefits in 2026 (OM Remchannel)

11 February 2026 19:48

Romance scams hit overdrive this Valentine’s week, warns Fraud Prevention Service

11 February 2026 19:00

Standard Bank optimistic about SA sustaining economic momentum, highlights risk factors