Why AI can’t replace your financial planner

Chante Ho Hip

1 December 2025 | 12:00“In a true financial plan, it is different strokes for different folks," says Certified Financial Planner Paul Roelofse.

- 702

- 702 Weekend Breakfast with Gugs Mhlungu

- Artificial Intelligence (AI)

- Financial Literacy

- Personal finance

- Gugs Mhlungu

As artificial intelligence gains further popularity, more people turn to it for help with mundane tasks and even advice on personal financial matters.

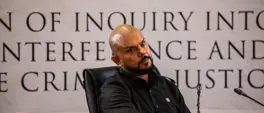

Speaking to 702’s Gugs Mhlungu, Certified Financial Planner Paul Roelofse says ignoring AI would be a disservice.

It is a great tool for efficiently handling data, but it is important to recognise that it lacks the emotional intelligence that is needed for personalised financial planning.

“In a true financial plan, it is different strokes for different folks. You have, as a financial planner, the approach to look at the situation at hand, where are the people in the plan in terms of their life stage, why do they need it, and what is important?” he says.

RELATED: Financial advice is affordable! Check this out, and GROW your wealth in 2026

Unlike certified financial advisors, who are accountable and provide recourse for poor guidance, AI tools generate information from internet sources without accountability or regulatory oversight.

“Financial advice issued by a planner is governed very carefully and regulated, and you do have recourse for bad advice,” Roelofse added.

AI works best as a complementary tool rather than a standalone solution.

RELATED: Personal finance: How small steps can achieve BIG results

“It is the responsibility of the person receiving the information to make sure where it comes from and whether it is valid, and it’s not perfect either,” he says.

To listen to Roelofse's conversation with 702’s Gugs Mhlungu, click below:

Get the whole picture 💡

Take a look at the topic timeline for all related articles.