SA needs financial system that will unlock investment billions to drive growth, address inequality - NPC report

Paula Luckhoff

3 December 2025 | 18:57Vast amounts of capital circulating in our financial system are not being reinvested into the economy, particularly into infrastructure, according to a comprehensive new report released by the National Planning Commission.

Picture: Pixabay.com

Huge amounts of capital circulating in South Africa's financial system are not being reinvested into the economy, warns a new report released by the National Planning Commission (NPC).

The Transformation of South Africa’s Monetary Architecture report spans the period from 1983 to 2024.

It defines this monetary architecture as the 'interconnected web of public, private, and hybrid balance sheets that channel credit, allocate capital, and govern investment'.

The report argues that South Africa’s post-apartheid growth model has failed to reconfigure the deep structural inequalities embedded within it:

"Instead, the current system continues to produce patterns of financial exclusion, underinvestment in fixed capital, and economic extractivism, while rewarding short-term profit-taking over long-term productive investment in Gross Fixed Capital Formation."

Primarily, what we need is much greater levels of investment in gross fixed capital formation (GFCF), says report co-author, Professor Mark Swilling. This refers to investing in particularly public infrastructure (especially energy, water, transport and digital), as well as the fixed assets that businesses require to expand.

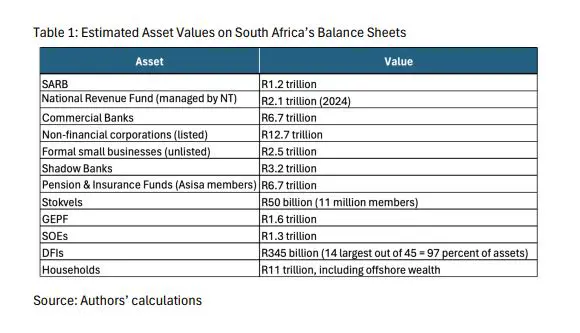

Estimated asset values on South Africa’s balance sheets in 2024 - NPC report

Prof. Swilling notes that South Africa's GFCF has been declining substantially since 2008 - while the NPC target is equal to 30% of GDP, we have never gone above 20% and are now sitting below 15%.

He explains that the architecture of a financial system is a complex one, involving multiple dynamics and institutions, with no central power to coordinate it.

What matters is the relationships between the most important 'balance sheets' to redirect funds constructively, he says.

"Every household has a balance sheet, every company has a balance sheet, every major bank has one... and all these balance sheets are linked together. Everybody's asset is somebody else's liability and vice versa. So, what we actually need to do is make more incremental adjustments to these relationships."

To illustrate this point, Swilling refers to the Development Bank of Southern Africa (DBSA) and its expansion of the Infrastructure Fund.

"The aim is to take R100 billion from the fiscus in order to leverage R900 billion from the institutional investors to create an infrastructure fund of R1 trillion. That's an example of where you're using the balance sheet of the state, the balance sheet of institutional investors and the balance sheet of a development finance institution to redirect the flow of money."

The report details ways of achieving more effective macro-financial governance of

SA’s monetary architecture to address underinvestment in GFCF.

Scroll up to the audio player to hear more from Prof. Mark Swilling

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

4 February 2026 20:50

How client ended up paying R62k in premiums after cancelling car policy, but not specifying the add-ons

4 February 2026 20:12

Zimbabwe set to start operations at 'continent's first lithium sulphate plant'

4 February 2026 19:45

Public-private partnerships critical in growing SME sector, says Minister at JSE capital matching event