SA Reserve Bank to announce first repo rate decision for 2026

Nokukhanya Mntambo

29 January 2026 | 3:55While a majority of economists believe the central bank will be cautious in its approach, factors including a stronger rand against a weak US dollar could work in consumers' favour.

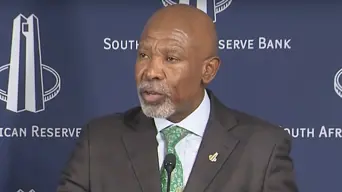

A YouTube screengrab of SA Reserve Bank Governor Lesetja Kganyago delivering the Monetary Policy Committee’s January statement on 25 January 2024.

Pressure continued to mount on the South African Reserve Bank (SARB)'s Monetary Policy Committee (MPC) to ease policy rates as the six-member team prepares to announce the first repo rate decision of the year.

This comes despite expectations that the MPC will keep the repo rate unchanged at 6.75% on Thursday, following a 25-basis-point cut in November.

While a majority of economists believe the central bank will be cautious in its approach, factors including a stronger rand against a weak US dollar could work in consumers' favour.

The chairperson of the Seeff Property Group, Samuel Seeff, is calling on the SARB not to miss the window of opportunity to provide vital interest rate relief to consumers, the economy, and the property market.

He said the country is in a unique phase where all important economic indicators are aligned perfectly with the central bank’s mandate, providing every opportunity for a meaningful rate cut.

On top of calls for a 25-basis-point cut today, Seeff said the MPC should also set the tone for a further 25-basis-point cut before mid-year.

While he said there is room for policy easing, Sanlam Investments economist Patrick Buthelezi said it was a question of timing.

"Policy easing can resume once there's clarity on electricity tariffs, and the SARB is confident that inflation is firmly trending towards the target. That said, the weakened US dollar, combined with favourable terms of trade, has supported the rand, which bodes well for lower imported inflation. Although inflation expectations remained above 3% and vary across survey participants, they've been drifting lower," Buthelezi said.

"Overall, given the strong arguments for both holding the repo steady for now and cutting, the MPC is likely to be divided on the decision. We expect the MPC to maintain a cautious approach, even as it remains biased towards easing this year."

The prime lending rate sits at 10.25%

Get the whole picture 💡

Take a look at the topic timeline for all related articles.