Motorists feel the pinch as vehicle debt ticks up

Nokukhanya Mntambo

14 November 2024 | 7:54Since the third quarter of 2016, the share of vehicle debt has increased from 20% to 24% in the same period this year.

JOHANNESBURG - Debt management company DebtBusters says motorists are feeling the pinch as vehicle debt ticks up.

Since the third quarter of 2016, the share of vehicle debt has increased from 20% to 24% in the same period this year.

DebtBusters has released its latest debt index which gives some insights on household finances for consumers under debt management.

ALSO READ: Debt management increased by 6% in Q3, says DebtBusters

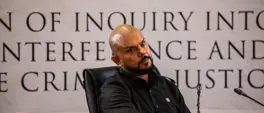

The executive head at DebtBusters, Baney Sager, said unsecured debt is also on the rise.

This includes credit card debt, overdraft facilities, personal loans and store cards.

“The average interest rates for personal loans is quite high – it’s 26.7% on average and this is getting pretty close to the legally allowable maximum level of 29% and what this means is that our personal loans have become very expensive. That was a bit of a surprise for us.

“The second surprise was that over the last few quarters leading to 2023/24, we saw that consumers were spending less of their take-home pay for debt repayment.”

Get the whole picture 💡

Take a look at the topic timeline for all related articles.