Expanding list of tax-free food items won't benefit poorer households: Treasury

Lindsay Dentlinger

30 May 2025 | 12:53It said that past experience has shown it would benefit retailers instead.

CAPE TOWN - The Treasury doesn’t believe that expanding the basket of tax-free food items will have the desired effect of lowering living costs for poorer households.

It said that past experience has shown it would benefit retailers instead.

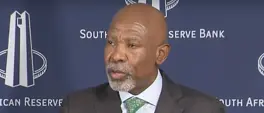

Along with retracting a proposed value-added tax (VAT) increase in the third version of this year's national budget, Finance Minister Enoch Godongwana announced last week that the Treasury would also no longer be adding more items to the essential list of 21.

During public hearings on the budget this week, the South African Poultry Association and dairy manufacturer, Clover SA, appealed to Parliament for chicken and dairy liquid blends to be zero-rated to ward off malnutrition, and to offset the impact of the impending fuel levy increase next week.

ALSO READ:

- Food industry makes appeal for Godongwana to retract decision not to expand zero-rated food basket

- Budget 3.0: Treasury makes U-turn on expanding zero-rated food items list

But Treasury’s taxation head, Chris Axelson, said on Friday that zero-rating was viewed as a "blunt instrument".

He said that when the basket was last expanded in 2019, retailers only dropped prices between seven and eight percent and not by the standard VAT rate of 15%.

"So the R5 billion that government is losing, about half of that is going to lower-income households, and the benefit of lower prices, and the other half is going either to retailers or the distributors."

Axelson said that Treasury believes the current list of zero-rated items was well-targeted to spare poorer households.

"If there is no VAT rate increase, we don’t believe it is the best course of action to continue with that zero-rating."

Axelson pointed out that agricultural producers stood to gain from a diesel rebate to mitigate against increased food prices as a result of the fuel levy hike.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.