A local just bought a R157m house in Cape Town. How much he/she must earn to afford the home loan...

Celeste Martin

1 August 2025 | 9:30Clifton in Cape Town recently saw a home sold for R157 million to a South African. A CEO on steroids? Here's how much you'd need to take home to buy something similar.

R157 MILLION!

That’s the jaw-dropping price one seriously loaded South African recently paid for a family home on Nettleton Road in Clifton, an area widely considered to be Africa’s most exclusive address.

This record-breaking sale makes it the priciest residential property sold in the country this year… and for good reason.

The home boasts sweeping views of the Atlantic Ocean and the majestic Twelve Apostles, plus all the bells and whistles you’d expect at that price.

Think private gym, sparkling pool, plush cinema, in-house elevator and a whole lot more.

ALSO READ: PICS: Is it you? Which wealthy South African just picked up this Cape Town pad for a whopping R157m?

Now, because most of us can only afford a place like this in our dreams, we got curious…

How much would you need to earn to buy a home like this?

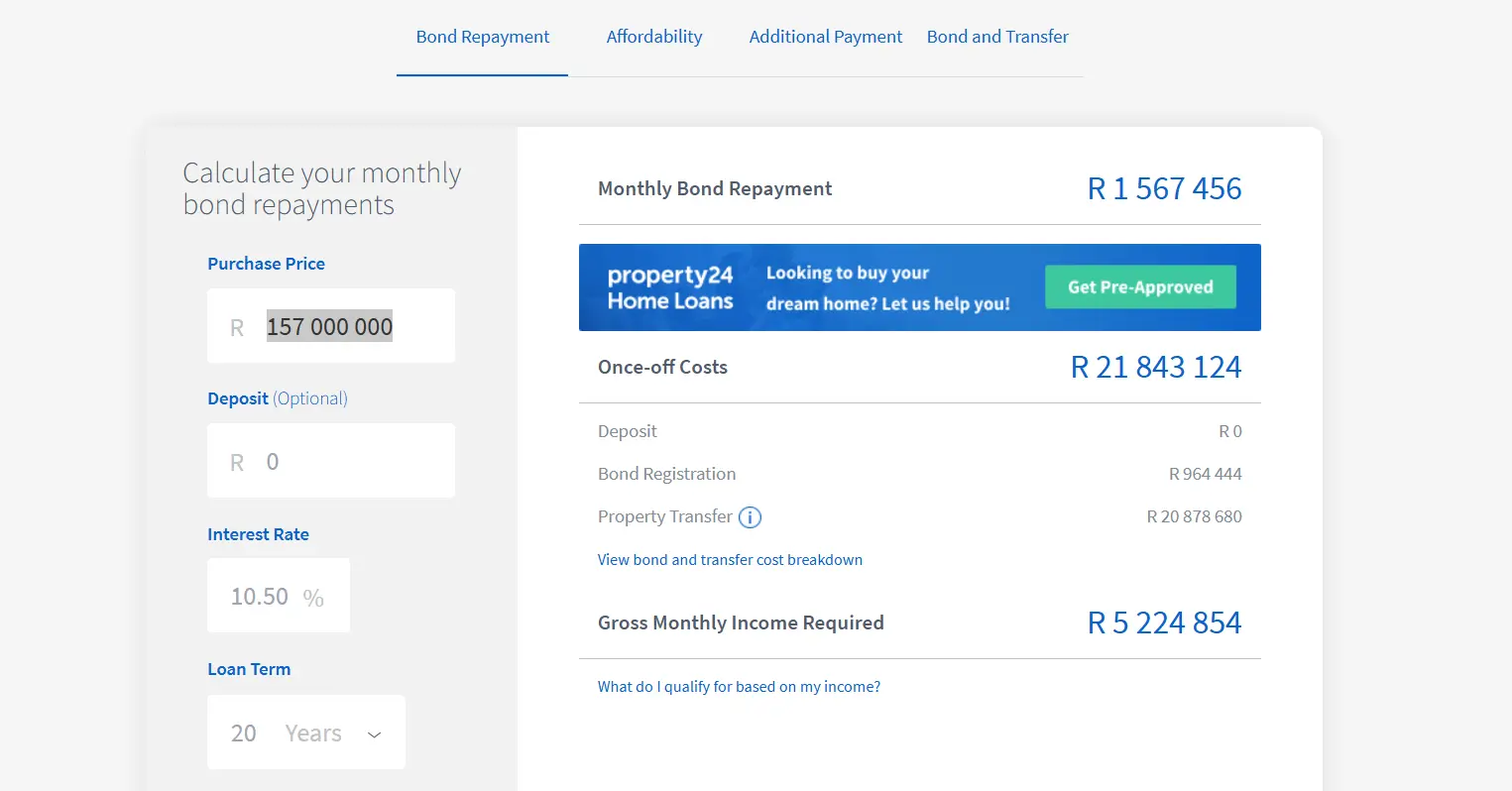

According to Property24’s bond calculator, you'd need to earn a gross monthly income of around R5.2 million to qualify for a home loan big enough to cover that price tag (assuming a standard 20-year term with a 10.5% interest rate, and no deposit).

That’s over R62 million a year!

To put it in perspective, even top CEOs, professional athletes, and celebrities in South Africa would have to stretch to meet that kind of income requirement... and that’s if the buyer used financing at all.

Odds are, they paid in cash or had access to seriously high-end financial structuring.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.