Final day for non-provisional taxpayers to submit their SARS returns

Lauren Isaacs

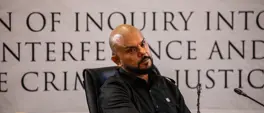

20 October 2025 | 4:45SARS Commissioner Edward Kieswetter warned that failure to submit a return on time, is a serious offence, and non-compliance could lead to administrative penalties and interest charges.

© jarretera/123rf.com

If you still haven’t filed your tax return, today is the last day to do so.

It is D-Day for non-provisional taxpayers to submit annual income-tax returns.

In a statement last week, SARS Commissioner Edward Kieswetter warned that failure to submit a return on time, is a serious offence, and non-compliance could lead to administrative penalties and interest charges.

At the time, he said 80% of taxpayers had filed before the 20th of October deadline.

This includes about six million taxpayers who had been auto-assessed and received their refunds within 72 hours.

The South African Revenue Service (SARS) said that it has made every effort to simplify and support the filing process.

Through enhanced digital platforms, Auto Assessment, and accessible helplines -- the revenue service says taxpayers have been empowered to meet their obligations with ease and efficiency.

Kieswetter said that s part of their strategic focus to encourage voluntary compliance and enforce the law, SARS will continue to identify and act against those who do not meet their tax obligations.

He said while many taxpayers wait until the last minute to file their returns, hoping to meet the deadline, rushing invites errors, misjudgments, unnecessary stress, and long queues at SARS branches.

Filing early however, protects taxpayers from penalties and ensures a refund, if due, payable within a period of 72 hours.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.