Buy now, pay later booms in SA

Chante Ho Hip

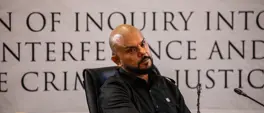

6 February 2026 | 7:08Dehan Scherman of Financial Wealth Holdings says BNPL's are easy to abuse because they don't require credit agreements.

Close-up of man holding out credit card for payment. Pixabay/jarmoluk

The use of buy now, pay later (BNPL) products has significantly increased in South Africa over the last year.

The facility allows consumers to split payments for purchases when they cannot afford to pay upfront.

Dehan Scherman of Financial Wealth Holdings explained that the concept is gaining popularity due to the high cost of living, but it can lead to over-indebtedness and financial stress.

He added that people who most likely use these schemes are those who cannot access traditional credit or are already over-indebted.

“It is interest-free if it is paid on time. The provider pays the merchant upfront, and the consumer pays the provider over weeks or months.”

Scherman noted that it is important for consumers to practice responsible borrowing.

The National Credit Act does not apply to these schemes as they are not classified as credit agreements.

This makes it easy to abuse, he added.

“If you take out too many of those at once, then your repayments start growing to the point where you might not be able to afford it.”

To listen to Scherman in conversation with 702 and CapeTalk’s Africa Melane, use the audio player below:

Get the whole picture 💡

Take a look at the topic timeline for all related articles.