China opens massive market to African businesses with zero tariffs

Kopano Mohlala

7 November 2025 | 12:06John Perlman speaks with Sithembile Dlamini, Head of Africa China Banking, about how African SMEs can access the Chinese market and achieve scale and sustainability.

Listen to the full interview below...

The scale, distance, and cultural differences may make businesses hesitate to trade with China. But a notable shift is taking place, opening up a world of opportunities and fostering a more balanced partnership between Africa and the global economic giant.

The numbers speak for themselves. Bilateral trade between China and Africa reached an estimated $295.6 billion in 2024. But the real game-changer is a recent policy move: China has announced zero-tariff access for all African countries. This isn't just a statistic; it's a runway for African businesses to diversify their markets, mitigate risk, and build strong, lasting relationships.

So, what does the current state of this vital relationship look like after years of development?

According to Sithembile Dlamini, Head of Africa China Banking at Standard Bank Business and Commercial Banking, the evolution has been significant. "It was largely driven by China's demand for Africa's raw materials," she notes, "but today we're seeing a more balanced, dynamic, and diversified one, looking primarily at agriculture."

This shift marks a maturing partnership. African businesses are no longer just exporters of commodities. They are increasingly selling "manufactured products, processed goods, and value-added goods," Dlamini explains. Meanwhile, Chinese companies are actively seeking out investment opportunities, supply chain diversification, and new markets in Africa.

But how can an African small or medium enterprise (SME) hope to find a foothold in such a massive and complex market? The perceived barriers are real. As Dlamini points out, "China is very dynamic and it's a massive market... there's about 1.4 billion people [and] twenty-three provinces that you would be navigating as an exporter.

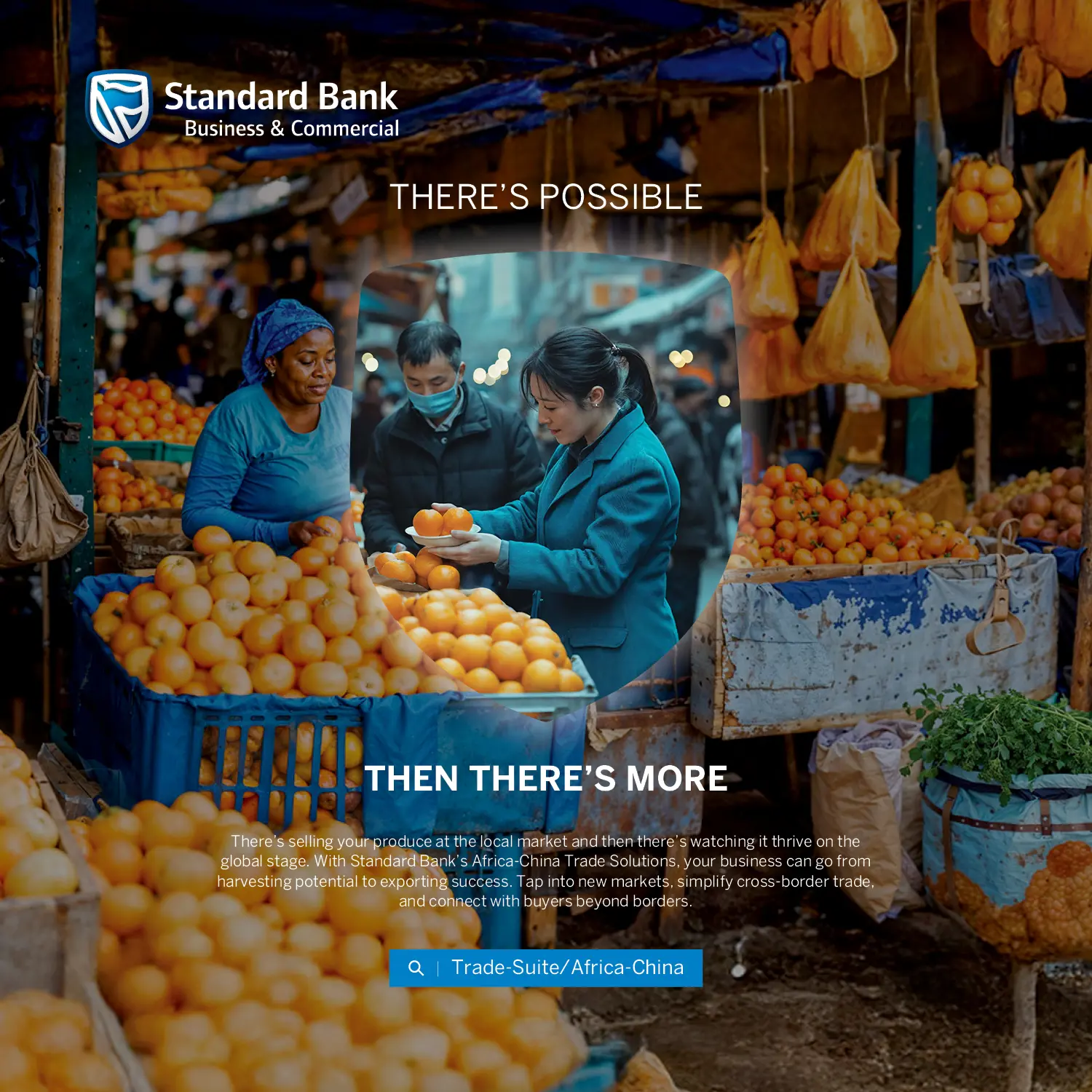

This is where targeted support becomes critical. To simplify and accelerate trade, solutions like Standard Bank's Africa China Trade Solutions serve as comprehensive guides. "It's a combination of financial solutions, trade facilitation, and market access support all under one umbrella," says Dlamini. This includes assisting exporters in connecting with reliable buyers, offering financial and logistical support, and, importantly, providing risk mitigation.

In a world of global economic uncertainty and shifting tariff regimes, this access to the Chinese market offers a compelling alternative. Dlamini sees this as a key driver for market diversification. "There's a lot of reliance on markets such as the US [and] Europe," she says, "but you see more and more companies that are looking at China for exports."

The zero-tariff announcement is particularly powerful because of its simplicity. Unlike complex reciprocal trade models, Dlamini clarifies that this move is "really just opening up the market for African products into China and trying to create that win-win situation."

The door is open. The path, while still requiring careful navigation, is being cleared. For African businesses looking beyond traditional markets, China represents a dynamic and increasingly accessible frontier for growth. The partnership is evolving, and the potential for those ready to step forward has never been greater.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.