Cell C’s JSE debut draws upbeat market response

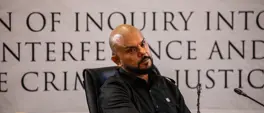

Kopano Mohlala

17 December 2025 | 8:55In a conversation with Stephen Grootes, Cell C CEO Jorge Mendes reflects on the mobile operator’s upbeat first day on the JSE, where its shares climbed 4% in early trading.

This content is sponsored by Cell C

The mobile network’s shares opened at R26.50, closing slightly higher and valuing the operator at just over R9 billion. While this initial market cap fell short of some pre-listing projections, CEO Jorge Mendes struck a tone of focused optimism. “It’s an exciting day for us,” Mendes said. “Would we have preferred a higher valuation? Certainly. But we are perfectly comfortable, and from here, we see only upside.”

That confidence is rooted in a fundamental strategic shift. Rather than engaging in a costly arms race of building physical infrastructure against giants like Vodacom and MTN, Cell C is betting on a “capex-light” future.

The company has shifted to a virtual network model by purchasing network access and capacity from larger rivals. This partnership provides Cell C customers coverage through a combined total of 28,000 radio base stations, compared to the 5,500 towers it owns. Mendes argues this isn’t a compromise but a glimpse of industry consolidation. “Having another base station next to three or four existing ones doesn’t seem logical,” he notes, suggesting shared infrastructure is inevitable. This approach enables Cell C to redirect its capital into customer-focused growth initiatives.

Cell C is now listed on the JSE

The company is driving growth across four areas. Its large, traditional prepaid customer base remains central, despite stiff competition from players like Telkom. A recently re-acquired postpaid business, now stabilised, is being targeted for revival. The enterprise division is pursuing government and corporate contracts from a modest starting point. However, its standout is the Mobile Virtual Network Operator (MVNO) platform, which already serves 4.7 million customers for partner brands.

This segment enables retailers or banks to offer mobile services on Cell C’s network, creating a high-growth, partnership-driven revenue stream without incurring massive customer acquisition costs.

A critical question lingers: Does this clever model create a dangerous dependence on the very rivals Cell C competes with? Mendes believes the industry’s trajectory provides a natural hedge.

He anticipates further infrastructure sharing and points to emerging technologies, such as low-orbit satellites, that could reduce reliance on terrestrial towers. “We own spectrum, we own our core network… we have all the aspects of a full operator except the physical towers,” he explains.

The goal is to be agile in a changing environment. With a lean team of just 900 people and a partnership-led approach to entering new market segments, Mendes argues that Cell C’s structure is its strength. “That’s what keeps you sharp and focused,” he says of the competitive pressure.

Cell C’s JSE listing is more than just a financial milestone; it’s the unveiling of a contrarian approach for survival and growth in a saturated market.

By avoiding the traditional capital expenditure-heavy approach, the company bets that agility, strategic partnerships, and targeted investments in specific growth areas will be more beneficial than owning the most physical assets.

For the market, the coming years will be a real-world test of whether this leaner, more collaborative model an establish a sustainable, profitable future in the shadow of titans.

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

5 February 2026 20:50

SA's reforms 'on track', but BLSA raises red flag over 'U-turn' in electricity sector

5 February 2026 20:17

Dating app burnout: Swipe fatigue is affecting online daters, says survey

5 February 2026 19:34

Adrian Maizey on the coffee business and managing to expand Starbucks in SA during the pandemic