Want to buy property? You may want to reconsider your car loan

Kabous Le Roux

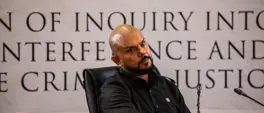

31 December 2025 | 7:28Car loan or home loan? Certified Financial Planner Gerald Mwandiambira warns consumers to weigh long-term costs.

As South Africans grapple with debt and rising living costs, financial experts are warning consumers to think carefully before choosing between taking on vehicle finance or committing to a home loan.

"The number one reason most people are declined when they apply for a home loan is that they’ve purchased a car,” says Mwandiambira. “A car loan has a significant impact on affordability.

“Home loans are easier to apply for if you don’t have a car loan.”

While cars are often seen as necessities, particularly in cities with limited public transport, analysts caution that a car loan is one of the most expensive forms of debt a household can carry.

Unlike property, which appreciates over time, vehicles lose value almost immediately after purchase. This means borrowers often end up paying interest on an asset that is worth significantly less than the outstanding loan balance within just a few years.

Home loans, by contrast, are typically structured over longer periods and come with lower interest rates compared to unsecured credit or vehicle finance. Property also tends to hold or grow its value over time, making it a more stable long-term financial commitment, particularly for households looking to build wealth.

Financial advisers say a common mistake is focusing only on the monthly instalment rather than the total cost of credit. A car loan with a shorter repayment period may appear manageable, but higher interest rates and additional costs such as insurance, fuel and maintenance can quickly strain a household budget.

Housing costs, while substantial, often replace existing expenses such as rent. Over time, repayments contribute toward ownership rather than consumption, which is why property is viewed as a better financial foundation.

“If you’re wondering whether to buy a home or a car, get a home loan first,” advises Mwandiambira.

However, experts stress that affordability remains key. Overextending on a home loan can be just as damaging as taking on expensive vehicle debt.

Consumers are also urged to consider whether a car is essential or whether a more affordable option could meet their needs. Buying a cheaper vehicle or delaying a purchase until finances improve can free up income for savings or reduce overall debt exposure.

Financial planners recommend that borrowers align major credit decisions with long-term goals rather than lifestyle pressure. With economic uncertainty expected to persist, careful planning and realistic budgeting remain critical to avoiding financial distress.

To listen to Mwandiambira in conversation with 702/CapeTalk's Africa Melane, click below:

Get the whole picture 💡

Take a look at the topic timeline for all related articles.