Emotion vs the spreadsheet: Rethinking the true cost of buying a home

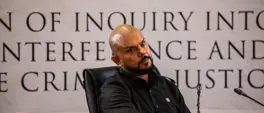

Kabous Le Roux

5 January 2026 | 8:55Buy or rent? The debate isn’t going away, but Certified Financial Planner Warren Ingram says the real mistake is choosing a side without understanding both the financial and emotional trade-offs.

The age-old debate about whether buying a home is a smart financial move or an emotional trap is unlikely to be settled anytime soon. But, according to Ingram, the real mistake many people make is choosing one side of the argument without fully understanding the other.

Emotion versus the spreadsheet

Ingram says decisions around buying property are often driven by emotion and tradition, rather than careful analysis.

Many people are encouraged into home ownership early in their careers, often because parents or grandparents insist it’s the ‘right thing to do’. But while it may feel sensible, it’s rarely interrogated properly.

“This is probably the biggest financial decision most people will ever make,” he notes, adding that it’s critical to understand both the emotional benefits and the financial trade-offs before committing.

It is entirely possible, he says, to make a great lifestyle decision that turns out to be a poor financial one.

Why your grandparents’ house isn’t the investment you think it is

A key argument in favour of buying a home is the dramatic increase in property values over the decades. But Ingram cautions that this comparison is misleading.

While parents may proudly point out that their home cost a few hundred thousand rand decades ago and is now worth millions, this ignores the impact of inflation.

“House prices over long periods tend to track inflation,” he explained. In real terms, many homes have simply preserved buying power rather than delivered exceptional investment returns.

The difference is that a home is often the only asset people hold onto for 20 or 30 years, making price growth feel more dramatic than it is.

Renting versus buying: the real cost comparison

When comparing renting and buying identical properties, Ingram says homeowners almost always start off worse financially.

Bond repayments, interest, rates, levies, insurance and maintenance all add up quickly. Renters, by contrast, typically face a single monthly cost, plus utilities.

Over shorter periods – around three to eight years – renting is often the cheaper option. However, the equation shifts over time.

“If you stay in a home for eight to 10 years or longer, ownership tends to work out better financially,”he says, as transaction and maintenance costs are spread out and rental increases compound year after year.

The catch? Renters must save the difference between rent and ownership costs. If that money is simply spent, the advantage disappears.

The hidden costs that are catching homeowners out

In recent years, Ingram says the so-called ‘silent assassin’ costs of home ownership have escalated sharply.

Municipal charges such as sewerage, refuse collection, water and property taxes – particularly in parts of the Western Cape – have risen far faster than inflation.

“These costs might have been insignificant 10 years ago, but they’re now material,” he says, warning that they can undermine the long-term affordability of owning a home.

Why flipping homes every five years is a losing game

Ingram cautions against regularly buying and selling homes as families ‘move up the property ladder’.

Frequent transactions benefit estate agents, lawyers and the taxman far more than homeowners, due to commissions, bond registration fees and transfer duties.

“Buying makes sense over a long period. Doing it every five years just sends you backwards financially,” he says.

How home ownership changes as you age

As families grow older, the property equation shifts again.

Large family homes can become expensive, impractical and physically demanding to maintain, particularly for elderly homeowners.

Ingram says downsizing earlier – ideally in one’s 60s – is often far easier than waiting until later life, when change becomes more difficult.

Buying a correctly sized home at or near retirement can offer stability, security and predictability, provided there is no mortgage involved.

However, he stresses that for retirees under financial strain, selling a home and renting may be the most responsible decision – even if it comes at an emotional cost.

No single right answer – just informed choices

Ultimately, Ingram says the debate isn’t about proving whether property is an asset or a liability.

“It’s about understanding the full picture – financial and emotional – and making a decision that fits your life stage and circumstances.”

For more information, listen to Ingram using the audio player below:

Get the whole picture 💡

Take a look at the topic timeline for all related articles.