You can ‘fix’ your credit score. Financial advisor shares tips to get you started

Chante Hohip

17 July 2025 | 8:33The good news is it’s not forever; you can rebuild it.

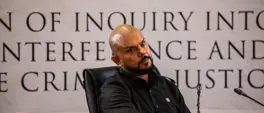

702’s Relebogile Mabojta speaks with financial advisor Luca Folpini.

Listen below:

Your credit score acts as a financial report card that demonstrates your reliability in managing your debt.

The higher the score, the better the loan and credit terms, as well as the interest rate.

A bad score makes it hard or, sometimes, impossible to obtain loans.

RELATED: YES! You can improve your credit score in Janu-worry by avoiding 3 things

Anything below 500 is a cause for concern; anything above 650 is a good score.

“Look at why you have a bad credit score. It’s usually due to late or missed payment or defaulting on your credit… or if you’re using too much credit.”

– Luca Folpini, financial advisor

Folpini shares tips for improving your credit score:

- Pay on time and reduce the balances you have

- Limit the amount of credit you use

- Paid up or no longer use your credit account? Don’t close it, there is history

- Stop applying for new credit when you don’t need it

If you feel like you’ve been unjustly scored, you can take it up with the credit bureau.

RELATED: Navigating credit: ‘It can go very wrong, very fast’

Get the whole picture 💡

Take a look at the topic timeline for all related articles.