SA won't get new water infrastructure until projects actually become bankable, says Futuregrowth

Paula Luckhoff

6 November 2025 | 19:06While South Africa has a water infrastructure crisis, it's not money holding us back but a lack of bankable projects, says Futuregrowth Asset Management.

Tap dripping water. Image credit: Pexels

It's well known that South Africa needs massive investment in water infrastructure, with recent protests in Gauteng highlighting the impact it has on communities.

But we won't get more of this needed infrastructure until water projects actually become bankable, according to Futuregrowth Asset Management.

RELATED: Joburg residents protest against ongoing water woes

The investment company says deepening infrastructure failures expose a critical weakness in South Africa’s development model which is the 'inability to convert available capital into bankable, investable projects'.

There are two aspects converging in this scenario says Senior Portfolio Manager Jason Lightfoot - along with the lack of bankability, comes the depressing list of

ageing infrastructure, poor maintenance and limited municipal capacity, which is particularly evident in Johannesburg.

The constraints aren't really around capital, Lightfoot emphasizes, but aroundensuring that projects meet the requirements that allow institutional investors to make their money available.

These requirements include things like regulatory certainty, transparent procurement processes and technical capacity at implementing institutions.

While recent proposals for effective financesolutions are gaining traction, such mechanisms cannot replace the fundamentals of sound, investable programme design, the company says.

The proposals include the introduction of 'blue bonds' for water projects on the JSE, together with blended-finance structures where development finance institutions (DFIs) provide tools like concessional loans.

Credit-enhancement structures CAN make marginal projects viable and reduce the cost of capital where fundamentals are sound, Lightfoot says, but 'cannot compensate for weak governance or limited delivery capacity'.

For more detail, listen to the interview audio at the top of the article

Get the whole picture 💡

Take a look at the topic timeline for all related articles.

Trending News

More in The Money Show

18 December 2025 19:31

Warner Bros. picks Netflix offer over Paramount buyout, but not a done deal yet

18 December 2025 18:47

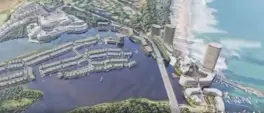

Reshaping KZN's North Coast: Dubai-based developer plans R20bn additional investment in Zimbali

18 December 2025 17:41

World's first 'Enhanced Games' will see athletes using approved performance-enhancing substances